How a Complex Roof Replacement Created a Better Property Funding Analysis Tool

A client came to me with an interesting scenario. A commercial property had a roof that was at the end of it’s usable life. The cost to replace with a new one was $200,000. The property that the client was managing had reserves. However, the reserves alone weren’t quite enough to cover the full cost. Three of the seven partners that collectively owned the property wanted to contribute additional cash directly in exchange for increased distributions over time. The other four preferred to participate in a loan for their share. The client needed to figure out each partner’s contribution, how loan payments would split, what the new distributions should be, and what return on investment each direct contributor would actually receive.

When the client first brought me this exact scenario, I asked how they were currently handling these calculations. They said, “I do it by hand.” I assumed they meant Excel or Google Sheets—already tedious for this kind of analysis, but manageable. To my surprise, they actually meant old school pen and paper, rechecking every number multiple times with a Texas Instruments BA-35 financial calculator to make sure each partner’s math added up.

Why This Gets So Messy

Most property managers doing this analysis probably aren’t using physical calculators anymore, but even those working in Excel face significant challenges. These aren’t simple percentage splits. Each partner usually has different appetites for debt and different cash-flow situations. Some partners have available capital and are willing to front their share directly if they can earn a better return than they’d get elsewhere. Others prefer to preserve liquidity and would rather take on debt. Essentially, each partner’s payback timeline and ROI look completely different based on their equity percentage and contribution amount.

How We Solved The Problem

After taking time to understand the problem at hand, I built an analysis tool that handles all of this complexity in real-time. Change any input—project cost, interest rate, partner percentages, distribution amounts—and every calculation updates instantly. What used to take hours of manual calculation into something you can change in seconds.

Want to see what happens if Partner 1 and Partner 2 both contribute directly instead of just Partner 1? Change one checkbox. Watch all the numbers recalculate instantly. Run scenarios. Test assumptions. Make informed decisions in a partnership meeting instead of “Let me get back to you with that information”.

Here’s what it actually tracks for you:

For Partners Contributing Directly:

- Their exact contribution amount (calculated from equity percentage)

- How much their monthly distribution increases

- Timeline to full payback (in months and years)

- Actual annualized ROI throughout the loan period

For Partners Taking on Debt:

- Their recalculated loan share (proportionally redistributed among loan participants only)

- Their monthly loan payment amount

- Their net distribution after loan payment

- How their new distribution compares to their original amount

For All Partners:

- Clear funding status (Direct Funder or Loan Participant)

- Side-by-side comparison of original vs. new distributions

- Their project share and equity percentage

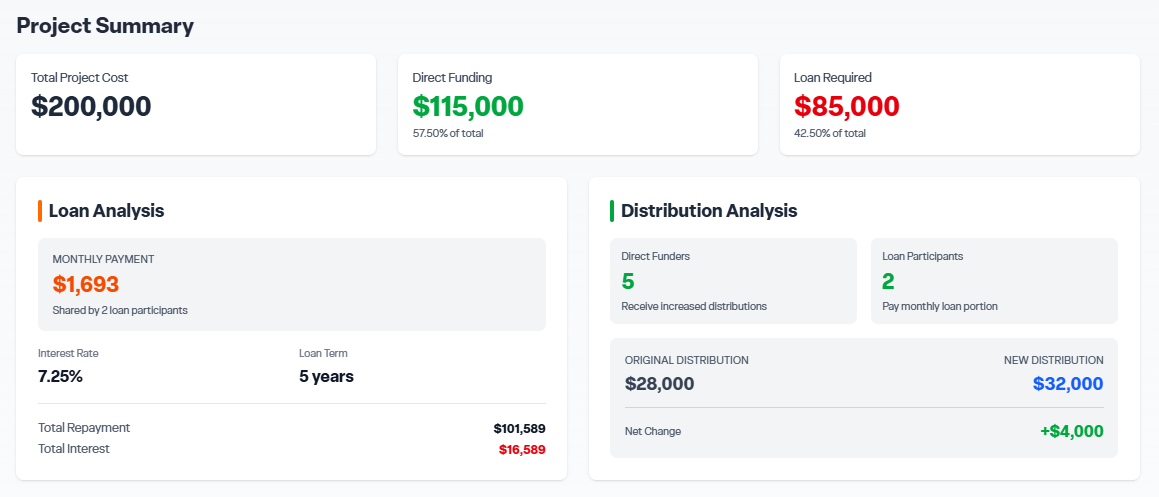

Summary View: This section provides an overview showing total project cost, direct funding vs. financed amounts, total monthly loan payment, and overall distribution changes across the partnership.

Project Summary section of the Multi-Partner Property Funding Analyzer

Project Summary section of the Multi-Partner Property Funding Analyzer

Suggested Distribution Calculator: The tool includes a feature that calculates a distribution amount designed to keep loan participants close to their original distribution levels—giving you a logical negotiating starting point that you can adjust based on your partnership’s circumstances.

Why This Matters Beyond That One Roof

Variations of this scenario occur across countless commercial and investment properties:

- HVAC replacements

- Parking lot resurfacing

- Building renovations

- Emergency repairs exceeding reserves

- Equipment purchases

- Property acquisitions requiring additional capital

The pattern is the same: multiple partners, different financial capacities, different risk tolerances, a major expense that forces the question of how to fund it fairly. A property manager facing these conversations needs to present clear, accurate options that the partners need understand their financial exposure without having to trace through spreadsheet formulas.

Try It Yourself

The client graciously agreed to let me open source this analysis tool as part of the CalcIt.io project. That means you, other property managers and/or owners facing the same puzzle can benefit from it too. Whether you’re modeling a scenario right now, preparing for a capital call you see on the horizon, or just curious how a complex partnership funding arrangement would actually pencil out, the Multi-Partner Property Funding Analyzer gives you the clarity to move forward.